Emerging Markets and Tapering: Some Thoughts

February 25, 2014

US monetary policy actions are transmitted across borders and influence emerging markets. In the last three years with accommodating US monetary policy, declines in US interest rates relative to emerging markets rates have motivated investors to rebalance portfolios toward higher-yielding assets. Asset purchases by the Fed have allowed for some rebalancing to occur in the domestic market, but in a world of global trade and integrated capital markets some investments have moved abroad resulting in capital flows to emerging markets. As a response, emerging market currencies have appreciated relative to US dollar.

The reverse moves are currently taking place as the Fed has started to reduce its asset purchases in response to a stronger economy and further reductions are expected to take place over the coming months with expectations of US rising interest rates in the medium term. This means that tightening should reduce capital flows to emerging markets and increase downward pressure on emerging market currencies and asset prices.

While the Fed’s policy change and the tapering explain the moves in the global markets as a result of changes in the monetary policy there are three other factors that amplify the reaction on currency values, portfolio flows and asset prices in emerging markets.

- Growth prospects. Differences in growth prospects between US and emerging countries resulting in corresponding differences in expected investment returns. At the macro-level, the graph below shows that the differences in growth rates between advanced economies and emerging market economics are closely linked to capital inflows to emerging markets. Perceived declines in growth in emerging markets and/or increases in growth prospects in the US lead to portfolio outflows from emerging countries, diminishing asset prices and weakening currency values.

- Global attitudes toward risk. Shifting sentiments of global risks due to political or economic events cause investors to rebalance portfolios across asset classes resulting in corresponding movements in capital flows and currencies. Changes in monetary policy may affect risk attitudes as easing of monetary policy tends to lower volatility (measured by VIX) increase leverage of financial institutions, improve EM capital flows and increase currency values. The graph below shows the link between capital market volatility and emerging market economies flows. Increasing volatility yields contraction in flows to emerging markets.

- Emerging Markets Readiness. While emerging countries have improved macroeconomic policies and institutional frameworks they have not developed structural reforms to absorb possible spillovers from external global shocks. Economies with large current account deficits experience greater depreciations of their currency and substantial increases in their bond yields. When US monetary policy returns to normality with a reduced asset purchasing program, lack of readiness and domestic vulnerabilities will amplify the reaction to capital outflows, currency values and asset prices.

As we move to a normal monetary policy with increasing expectations for US interest rates to rise in the medium term, emerging markets face challenges from volatile capital flows with corresponding projected declines in asset prices as a result of investors portfolio rebalancing. Reassessment of growth prospects in emerging markets, changing in global attitudes towards risk and emerging market readiness all influence the dynamics for portfolio flows in emerging markets and asset prices.

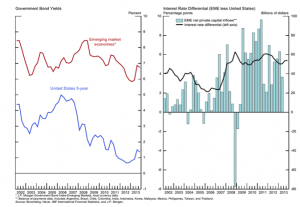

Interest Rates Differentials and Capital/Portfolio Flows to Emerging Markets

Expectations for increases in US interest rates result to declines in capital flows to emerging markets. Investors depart from emerging markets when the differential in interest rates increases in favor of US rates.

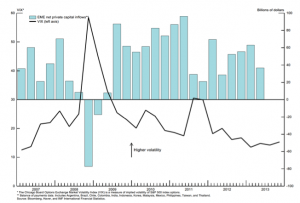

Risk and Emerging Market Capital/Portfolio Flows

Lower volatility in US markets is accompanied by increases in portfolio/capital flows in emerging economies. The reverse is true when in 2008 the US capital market experienced high volatility and portfolio flows moved away from emerging market economies.

Leave a Reply

You must be logged in to post a comment.