Modern Meritocracy Theory: Pledging Allegiance to an American MMT

August 16, 2019

GIC Member and supporter, Danielle DiMartino Booth, shares her latest article, on the Weekly Quill, addressing Modern Monetary Theory (MMT).

“Know that I shall never alter my ways, not even if I have to die many times.”

Before martyrdom, there was principle, there was Socrates. Unlike those moved to make the ultimate sacrifice for the greater good, driven by the purity of faith that God welcomes with open arms, Socrates had no such innate assurance. The Ancient Greek whose pupils scatter the filament of great thinkers lived in an era of gods, plural, to whom he pledged absolute fealty to his own orchestrated end. Despite the public’s awareness of his unmatched devotion to both those he worshiped and schooled, his enemies trumped up charges of “refusing to recognize the gods recog- nized by the state” and “corrupting the youth.” How Socrates came to be convicted remains either a mystery or a testament, depending on your own philosophy. There is no question of his unrivaled mental acumen. It follows that successfully defending himself to acquittal would have been a given. And yet, we know a death sentence ended the life of the man credited with founding Western philosophy.

In his own words, excerpted from his “Apology,” it is plain he is goading lesser minds: “If you say to me, Socrates, this time we will not mind Anytus, and will let you off, but upon one condition, that you are not to inquire and speculate in this way any more, and that if you are caught doing this again you shall die- if this was the condition on which you let me go, I should reply: Men of Athens, I honor and love you; but I shall obey the gods rather than you, and while I have life and strength I shall never cease from the practice and teaching of philosophy.”

To stand on principle all the way to death’s door? The irony of this travesty is the word “mar- tyr,” which would not enter the vernacular until four centuries after the death of Socrates in 399 B.C. It was from another teacher that martyr would take its meaning and its origin, the Greek word for “witness,” as in the Apostles who witnessed Christ’s crucifixion. And yet, Socrates knew that his teachings, for which much of the world was unprepared, would best withstand the test of time if he paid the highest price to preserve them. He didn’t give too much to a fault, but rather to a virtue.

Two millennia on, we’re in desperate need of devotees who worship at the altar of knowl- edge. Consider this other excerpt from Socrates’ “Apology”: “I tell you that virtue is not given by money, but that from virtue comes money and every other good of man, public as well as private. This is my teaching, and if this is the doctrine which corrupts the youth, my influence is ruinous indeed.”

Contrast this with the introduction to a popular website, “wecanhavenicethings.com”:

- “We CAN have nice things. We can provide a well-paying job for anyone who wants one. Medicare-for-All. Child care. Tuition-free public college and excellent public schools. Modern infrastructure including high-speed rail from city to city. We CAN have nice things that make all our lives better.

- We can (and must) implement a Green New Deal to de-carbonize the economy and ad- dress the climate crisis.

- And why not? The US government issues its own currency, it can’t “run out of money” or go bankrupt. That means “We the People” can — and should — spend what we need to spend on what we want and need without worrying about “how to pay for it.”

The landing page has as its inspiration an op-ed penned by the mother of Modern Monetary Theory (MMT), Stephanie Kelton, Bernie Sanders’ presidential campaign’s senior economic adviser. “Congress can give every American a pony (if it breeds enough ponies)” first appeared in the Los Angeles Times on September 29, 2017:

- “Are you telling me that the government can just make money appear out of nowhere, like magic? Absolutely. Congress has special powers: It’s the patent-holder on the U.S. dollar. No one else

is legally allowed to create it. This means that Congress can always afford the pony because it can always create the money to pay for it.

(But what of inflation, you ask?)

- “If the government tries to buy too much of something, it will drive up prices as the economy struggles to keep up with the demand. Inflation can spiral out of control. There are plenty of ways for the government to get a handle on inflation, though. For example, it can take money out of the economy through taxation.”

Before we address Kelton’s “solution” for rampant inflation, let’s walk through the series of events that would land the country at such a carefree juncture, and no, this has nothing to do with

presidential election potential outcomes.

Let’s approach today’s Quill the way Socrates would.

What conditions would prompt firing up the printing press, so to speak?

First off, the mechanics are deceptively simple. In an August 5th Bloomberg interview, Kelton was asked how the government would fund MMT’s programs. Her reply is that the govern- ment, “funds it the way it funds everything else…by instructing the Fed to clear the payments that Congress has authorized. It’s the government paying the tab rather than the rest of us.”

You begin to appreciate the “Monetary” in MMT when you see that the identity of the glo- rified clearing house being “instructed” is the Federal Reserve. To think, both conservative and liberal economists both inside the Fed and in the private sector have taken umbrage to being on the receiving end of directives when it is not Treasuries they are purchasing. As the MMT’ers explain, it is quantitative easing (QE) for the People as opposed to QE for the Banks.

Besides, it’s logical that the institution closest to the payments system, and committed to getting closer to it, be charged with doling out the monies directly to recipients whether it is those who would prefer to not work, or the doctor sentenced to carry out Medicare for All? The Fed has, after all, shown the country how to monetize debt.

As for the protests among Fed officials that it would never have anything to do with MMT, at its simplest level, every penny of QE undertaken by the Fed that cannot be unwound is monetized debt. That is precisely why Ben Bernanke had to commit to his colleagues to exit as expeditiously as he entered this grand experiment in order to garner the votes needed to push through QE2 and QE3, including that of one huge 2012 skeptic, Jerome Powell.

The Fed Monetizes the U.S. Debt

Regardless of who is doing the bidding, why would the Fed even consider QE with the highest overnight rates in the Western world?

Regardless of who is doing the bidding, why would the Fed even consider QE with the highest overnight rates in the Western world?

If you hadn’t noticed, the race to the bottom appears to have gained momentum since President Trump gambled that the threat to impose tariffs would succeed where bullying failed. If the Fed refused to give him the half-point rate cut he demanded, he would simply force markets to price in that missing quarter-point of easing. We know it worked. But it will also go down in history as one of the biggest backfires of his presidency.

China’s retaliation has catalyzed a global daisy chain of events. The trickle of central banks in- dicating their intent to ease or take baby steps in that direction with small rate cuts has turned into a rush to the exits. New Zealand lowered its reference rate by a half-point instead of the quarter-point priced in and India sprang for a 35-basis point ease, also in excess of what had been forecasted. We’re seeing “shock and awe” in the least likely places as countries queue to weaken their currencies trying to calculate how to weather the global economic slowdown. In a post Federal Open Market Committee appearance, St. Louis Fed President James Bullard openly acknowledged that he was the dovish member on the Committee. And yet, even as he watched the yield on the 10-year melt and the yield curve more deeply invert, he insisted the Fed was quite certain it had taken adequate measures to address the trade war. In response, normally brash Wall Street strategists are flaunting the Fed’s unified front and have begun to quietly speculate on whether an intermeeting rate cut is in the cards.

Can’t you just hear Doubleline’s Jeffrey Gundlach saying, “Clearly they were forced by the markets into this move, which only impairs their credibility.”? Except he did say those exact words, on January 22, 2008 when the Fed rushed in with an emergency rate cut seven days before the FOMC was scheduled to meet. Imagine the luxury of having 425 basis points off of which to hack 75, which is what the Fed did that day. But there is no place for wishful thinking amongst those who didn’t have the constitution to normalize rates.

So, we’re headed to the zero bound with no stops in short order?

In the last three rate cutting cycles, the Fed has averaged 23.4 basis points per month. That would put the fed funds rate right at the 1% line on New Year’s Day, give or take a basis point. Ergo, by May 1, 2020, we’re at the zero bound?

While the math and chronology work, it’s with good reason that the Fed should announce at its December 2019 meeting that is out of the rate-cutting game for good, stopping at a 1% fed funds rate. From thence, QE will start according to Fed Governor Lael Brainard’s plans to target Treasuries of one-year or shorter maturities.

But wait! The Bernanke Doctrine dictates that QE cannot begin until the fed funds rate hits zero.

What could possibly stop the Fed from returning to the zero bound and following the rest of the world into negative interest rate territory?

A recent discussion with QI colleague Jim Bianco of Bianco Research, with whom I’ll be fish- ing in the coming days in Maine, opened my eyes to the impossibility of the Fed imposing negative interest rates, even if the economy needed monetary policymakers to synthesize the added stimulus.

It’s important to caveat that Bianco is no sensationalist, not in any way. Nonetheless, in his estimation, the world financial order is at risk of imploding if the United States succumbs to negative interest rates. Channeling his own inner Socrates, Bianco posed the following question:

What assumption is so ingrained as to need not be articulated with regards to the financial system?

The answer is positive interest rates, which underpin every single model and scheme that defines the financial system. Think about it, every Nobel prize winning economist, every valuation model you can think of, all of them hinge on having positive interest rates as an input. To take but one example, according to the Black-Sholes option pricing model, if the interest rate input is negative, the value of the put or call is infinity.

Call positive interest rates the financial system’s release valve. Europe and Japan have had the luxury of annihilating their banking systems by right of the world retaining access to positive interest rates in the English-speaking world. That option is simply not open to us, which is a good thing.

“Insurers, pensions, banks, they would all crumble under negative interest rates,” said Bianco. “If you want to preserve the fractional banking system, the Fed needs to stop at 1% and not go any further.”

To use the most basic illustration, fractional banking’s century-old system takes in $100 in deposits, reserves a teensy fraction and lends out the rest. That money that fuels the system is then taken in by the next institution, reserved by that same fraction, and the subsequent new balance lent out. And so on. This process greases the skids of the operations of the United States’ banking system.

Now assume negative interest rates. That same $100 deposit would have to be fully reserved. In order to free up funds for lending, the bank would have to pay the depositor a set fee for a set time which it then pays back after a year.

Assuming the Fed stops at 1%, would the next step be automated, the natural progression to QE4?

For most of you, this question dares to flirt with the rhetorical. Of course the Fed would em- bark upon QE starting with the purchase of Treasuries. That would ensure the stock market, and in turn the economy, continue to feed off one another as they have for over a decade in the most virtuous of fashions.

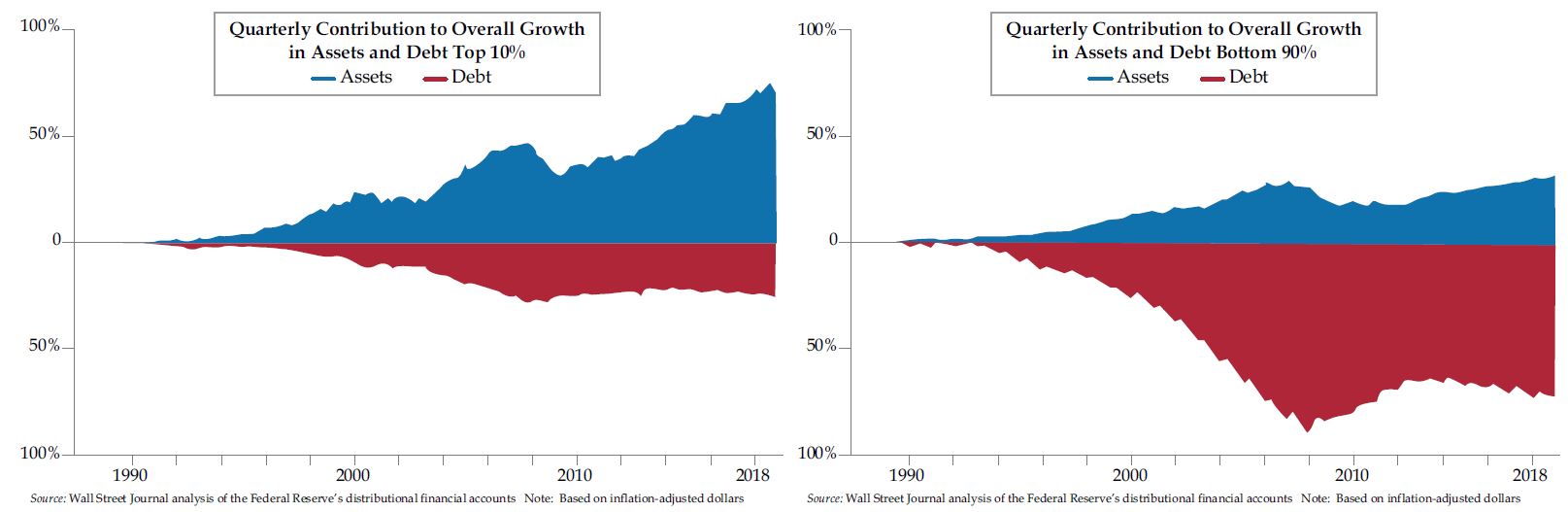

Nearly six years ago, in a CNBC interview, hedge fund legend Stanley Druckenmiller char- acterized QE as, “the biggest redistribution of wealth from the middle class and the poor to the rich ever.” By the looks of this lovely pair of graphs that recently ran in the Wall Street Journal, that wealth transfer continued unabated even as the Fed ceased and desisted its own QE program. It would seem that QE knows no borders.

To sum up the benefit or damage, depending on your perspective, “Debt among U.S. house- holds increased by nearly $9 trillion between 1989 and 2018, and 74% of that was issued to the bottom 90% of households by net worth. A majority of the growth in assets went to the top 10% of households.”

The Biggest Redistribution of Wealth…Ever

For whatever reason, I get the sneaking suspicion that the Druckenmiller video is required viewing in MMT 101 in the same spirit the movie “Wall Street” was on my first day at Don- aldson, Lufkin & Jenrette (true story). The immoral of that Michael Douglas classic was that, “Greed is good.” MMT-ers naturally and rightly take issue with this guiding principle but do appreciate the playbook QE has left behind.

To summarize, in order for a sovereign to borrow unfettered, there are but two prerequisites: A country must issue debt in its own currency and have access to a printing press. As Ms. Kelton noted in that Bloomberg interview, while it is not a requirement, holding reserve currency status “gives us an extra degree of freedom…” to run budgets in the interest of the people.

Are there impediments to unlimited borrowing?

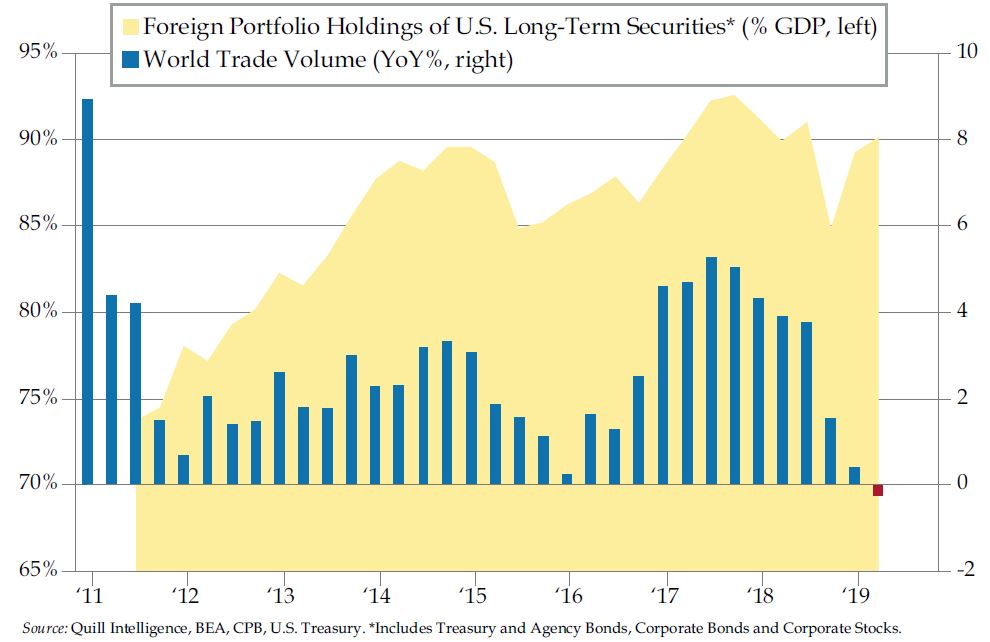

To give credit where it’s due, keeping the borrowing inside the homeland is a big plus. That makes Japan, the land where the QE sun first rose, the almost ideal incubator for MMT. If the yen held reserve currency status, the experiment would be perfectly devised. Conversely, if the U.S. was beholden to no foreign investors, we too would achieve model nirvana.

As you can see, we’re not quite there. There was a moment in time when U.S. stocks were in meltdown mode that the rest of the world stepped back from holding our securities in their various forms. But that was before world trade volumes turned negative for the first time since the last global recession. As if on cue, the rush into the safe haven of U.S. securities has been piercingly loud. While emblematic of how low yields are and how much more fragile other economies are at the moment, this chart does depict a potential area of weakness if the MMT game is to be played out to its end game.

U.S.: Beholden to the Kindness of Strangers

Turn your news off mute and you begin to under- stand why debating how unchecked debt creation via traditional QE into the banking system is moot. Re-launching QE when the country is splitting apart at the seams would be political poison and potentially impossible to carry out. And to be fair, MMT’s aims certainly do sound noble.

Turn your news off mute and you begin to under- stand why debating how unchecked debt creation via traditional QE into the banking system is moot. Re-launching QE when the country is splitting apart at the seams would be political poison and potentially impossible to carry out. And to be fair, MMT’s aims certainly do sound noble.

What is the good in MMT?

Another recent Wall Street Journal story bemoaning the inadequacy of public pension plan returns in 2018 got me to thinking MMT might be useful after all. Every time a story about Illinois melting or Con- necticut on the brink hits my Twitter feed, a bevy of do-gooders (and cynics) flood my feed with predictions that the Fed will simply bail out the pensions via QE.

This most recent story that pensions had once again fallen short and thereby tumbled further into underfunded territory prompted me to ask the MMT universe if the theory applied to pensions and any other unfunded debts, for that matter. In return, I was lectured on my in- herent misunderstanding of what MMT is all about. The thrust of the theory is that it creates opportunities for future generations by paying for just about everything. But MMT was not conceived to tend to yesteryear’s problems.

To this I replied, so let the elderly suffer? Round and round we went until finally, I received this: “If Congress wrote a bill directing the federal government to assume a state government’s pension obligations, then those payments would happen. End of story.” A link to “wecanhavenicethings.com” followed.

MMT for Boomers and Millennials Alike?

Of course, in MMT theory, borrowing costs are negli- gible and inflation nonex- istent such that no pension would need bailing out.

Of course, in MMT theory, borrowing costs are negli- gible and inflation nonex- istent such that no pension would need bailing out.

And how do interest rates get to “negligi- ble” levels?

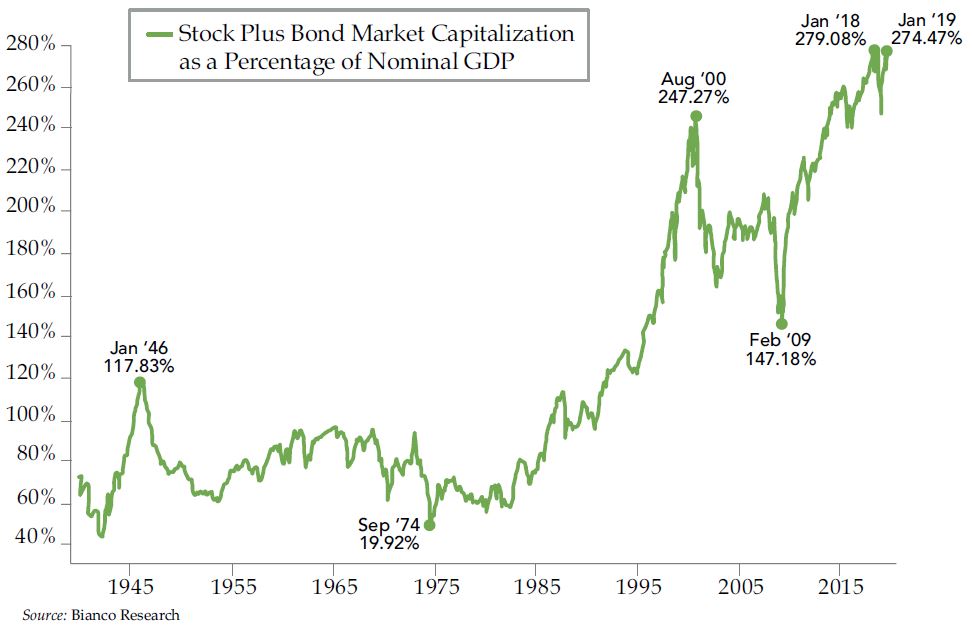

If there is one argument that shakes MMT to its foundation, it’s the pathway to rock-bottom borrowing costs. The appetite to revisit QE in any form, regardless of the beneficiary – Wall Street or Main Street – requires markets force either the Fed’s or Congress’ hand, assuming Congress is on board with legislating MMT in some form. And such acts only come about in desperate times, when the overvaluation game is up, and stocks and bonds implode under their own weight. Under such circumstances, even if the Fed has taken borrowing costs to 1% and stopped, the U.S. economy will be in recession.

Stocks and Bonds Touching Valuation’s Ceiling

Such a scenario would have both investors and MMT beneficiaries clam- oring for the Fed to deliver relief. And therein lies the rub.

Such a scenario would have both investors and MMT beneficiaries clam- oring for the Fed to deliver relief. And therein lies the rub.

Can MMT be success- fully deployed?

As Ms. Kelton herself concedes, if too much debt is taken on, which in turn ignites inflation, MMT will self-regulate by raising taxes. Under such a set- up, interest rates would be fixed and the tax rate, presumably on the wealthy, would be the variable. Set aside the impossibility of implementing such a system and go back to the backdrop against which MMT would be launched, or at least accepted as needed by malleable politicians with reelection in mind.

Recessionary times call for fiscal relief, especially if the Fed holds the line on interest rates and is hamstrung in the QE department, refusing to be enlisted to execute MMT. Consider the timeframe for the multiple acts of Congress. The Fed would have to be formally stripped of its independence to force MMT upon it sometime around…Christmas.

But let’s even go with that as a given.

If confidence in the Fed was shattered, the borrowing needs of the country would balloon overnight. Elderly poverty, social funding for the unemployed, pension bailouts, an acute housing crisis and federal entitlements would be in need of immediate emergency funding. To this, we’re supposed to tack on the MMT programs to raise the masses from their misera- ble stations, or at least make them happier souls.

This last aim certainly has worked on a micro-scale in Finland. Two years ago, a universal basic income pilot scheme was rolled out to address the stagnancy in its workforce, which should sound familiar to Americans, albeit on a wee bigger scale. Though employment has not risen, those on the receiving end of taxpayer monies are reported to be happier. As for expanding the program, Finnish politicians are wary of raising taxes as that might put off voters.

The illustrative hypotheticals are indeed to make a point. The natural governor to MMT is debt/GDP levels. Once breached, inflation is ignited, and taxes must rise. But, once again, in order for that critical threshold to be breached, we would need to be in recession.

To recap, the three critical elements to force MMT are:

- a confidence scare with regards to our omnipotent central bankers,

- which induces recession and a falling stock market,

- and a rising unemployment rate

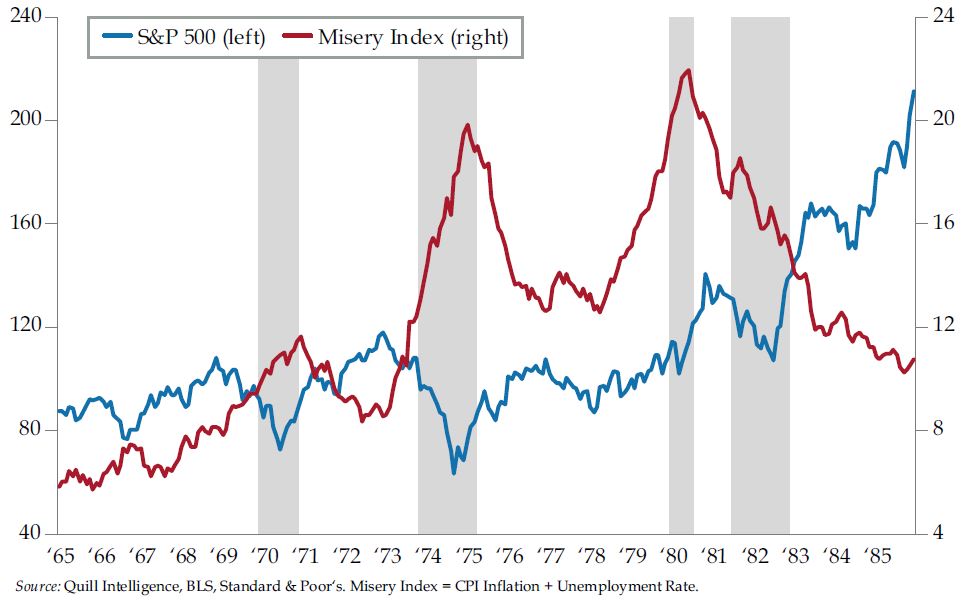

The subsequent national debt needs triggered would be on such a scale as to trigger inflation, a monetary phenomenon most under the age of 60 believe to be the stuff of dark folklore. To address rising prices, the rich would be soaked dry and assumed to remain U.S. citizens.

Perhaps the graph below can provide a historic and unfriendly reminder about how our citi- zenry and stock market react to inflationary recessions. It’s been a very long time. But beware of those who insist on “never again” dictating our collective future. The bottom line on MMT in America is that it will work splendidly as long as the economic backdrop is perfectly benign.

Markets Abhor Misery

And what of the rest of the world?

And what of the rest of the world?

It goes without saying that this stagflationary environment would not metamorphose in a cocoon. Other countries with access to their own printing presses would be playing this same high stakes game of MMT adapted to their econ- omies. We’ve already seen ample evidence of the propensity for other countries to panic at the first whiff of economic disadvantage. At the same time, Eurobonds would enter the vernac- ular and not in an auspicious way even as emerging market economies get caught in the crosshairs causing the global inequality divide to explode.

In the event you are waiting for a happy ending alternative, the closest you will get is the Fed drawing a hard line at 1% to preserve the sanctity of the banking system. Resisting the calls for QE, even if to avoid being dragged into the MMT net, would be a next best step. Would this leave a mark? Most certainly.

But perhaps the way forward, the way back to virtue being earned and not gifted, is by returning to the elements that forged the American Dream. We can reach deep within and elect leaders with the moral fortitude to tear down and rebuild our public education system. We can retain our liberties and the right to choose how we receive our basic necessities.

But we have to get there the hard way, one child at a time. Those precious building blocks of a great nation must mature into self-reliant adult Americans. These productive souls must then give blood, sweat and tears to invest in and grow our economy from the inside out, ensuring the groundwork is laid for future generations to then build upon that success.

If as Socrates lived and died to prove, knowledge is power, the U.S. would better strive to achieve a Modern Meritocracy rather than the alternative MMT on offer. There was a time the United States was not a nation struggling under the weight of its debts. We can return to the proud roots that preceded this shameful era and close history’s books on it once and for all. One child at a time.

To read more from Danielle, go to quillintelligence.com

The Weekly Quill provides a deep analysis into a broad range of subject matters ranging from the Federal Reserve, global monetary policy, earnings season, asset allocation strategy, commercial and residential real estate, private equity, public pensions and every aspect of the growing fixed income markets. The aim of the Quill is to help investment managers and chief investment officers position their portfolios for the medium and long-term.

Leave a Reply

You must be logged in to post a comment.