Monetary Policy and the Eurozone

November 11, 2014

ECB President Mario Draghi once again promised that he would do whatever it takes, indicating that the ECB’s balance sheet would be expanded to its previous high–adding one trillion euros. Like a good economist, he did not state how or when this would be achieved. There remain significant barriers to increasing ECB holdings as qualified private sector debt does not appear to be abundant enough and the German Constitutional Court still needs to weigh in on owning sovereigns. Federal Reserve Chair Janet Yellen, at a monetary conference in Europe, advocated for doing as much as possible. Deflation remains the bogey that haunts central bankers, even as the markets begin to think about higher interest rates in the US. We suspect those hikes will come later and be disappointingly small for many investors. Bottom line, with central banks still producing copious amounts of liquidity it is hard to see how interest rate will rise since competition for a single basis point of higher return will bring effectively unlimited funds.

While money supply continues to grow, demand appears to remain lackluster. Economic growth continues to falter in Germany and China, and the US payroll report suggests more of the same. There is no engine for stronger growth–and little policy directed at generating a strong recovery anywhere in the near term. After a rough August, Germany has had little more than a dead cat bounce in its September data. Industrial production was weaker than expected, up 1.4 percent in September, rebounding less than half the -3.1 percent decline in August. New orders rose a tepid 0.8 percent after a revised, but still deep, -4.2 percent decline in August. Exports rebounded 5.5 percent after a -5.8 percent decline in August, as trade–though flat–is the strongest sector in the economy. Many are arguing about whether third quarter real GDP will be negative, but the weak finish in September suggests no improvement in the fourth quarter either.

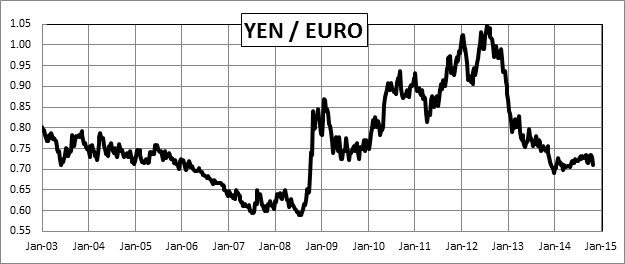

While monetary policy may stop deflation, the rekindling of conflict in Ukraine and the renewed decline in the Euro-yen bode ill for real economic growth. It takes roughly a year for exchange rates, interest rates, or commodities prices to work their way through to actual GDP. Germany is still fighting off the effects of a 33 percent plunge in the yen relative to the euro. They will have to wait a while before the recent decline in rates to 80 basis point for the Bund or the drop to sub $80 oil provide any significant lift in the real economy.

The preceding is an abridged version of a commentary for McVean Trading and Investments, LLC and has been reposted here with permission of the author.

The ideas and opinions expressed in this blog are those of the author, and they should not be perceived as investment advice or as any other kind of advice.

Leave a Reply

You must be logged in to post a comment.